Innovate or renovate – either way, disruption is already here! Since 2000, 52% of Fortune 500 giants have vanished. Whether through bankruptcy, buyouts, or outright extinction, this proves no empire is too big to fall.

According to a survey by Boston Consulting Group, 79% of CPG executives consider product innovation one of their top three priorities.

“Many Fortune 500 companies have created dedicated teams or departments focused solely on innovation. These groups are given the funding, resources, and mandate to experiment with new ideas and technologies that may not have an immediate clear business application. For example, Amazon has the Amazon X division that works on future technologies like delivery drones. Google’s X Moonshot Factory explores seemingly impossible ideas like internet-beaming balloons. By housing innovation teams separately from daily operations, companies give these groups more freedom to think outside the box.”

Ishalli Garg, Medium

However, from that 79% of CPG companies prioritizing product innovation, less than half of them (47%) are looking into their business model innovations, and only 29% are looking into deep-tech innovation. These companies are likely missing the mark and losing opportunities to truly innovate their products!

The effects of this are staggering: 80% of CPG companies are struggling to get innovation right, stuck in low-growth “stagnating” or “emerging” modes, while just 20% have figured out how to scale their efforts and see real “future-built” results.

Brands are looking to insights companies like Curion to help them discover areas to innovate to build that real “future-build” results.

But from inflation and supply chain issues to rising competitors, shifting consumer tastes, and the challenge of selling to new generations, the market landscape is in constant change. To stay ahead, brands need powerful product and market insights centered around the consumer to make the right calls.

Consumers influence consumers – in person, on social media, and in reviews, making the consumer the driving force behind effective brand strategy. And for many brands, understanding their consumer is also their largest marketing spend.

The provocative question that keeps emerging:

Do consumers even know what they truly want?

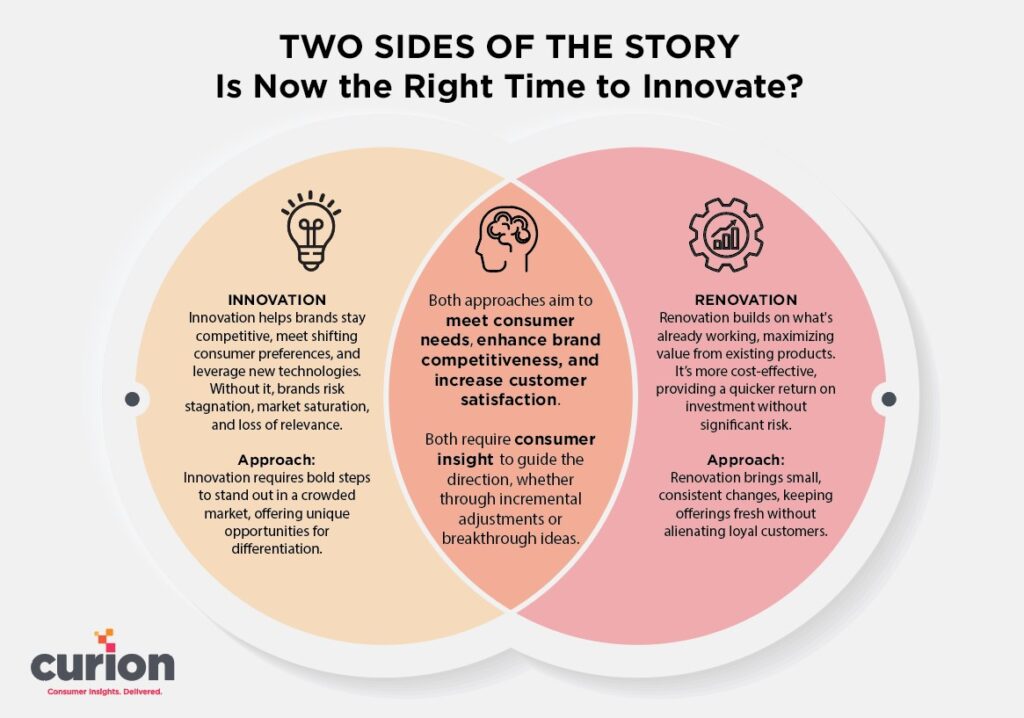

The fluidity in consumer preferences is forcing brands to rethink their approach: refine what works or launch new innovations. By tapping into real consumer insights, brands can make this choice with confidence – staying sharp, connected, and one step ahead in a market that never sits still.

Is Now the Right Time to Innovate?

In 2024, 65% of global CPG launches (food, drink, household, health, beauty, personal care, and pet care) have been renovations in the form of line extensions, reformulations, package changes, or relaunches. This leaves only 35% to be true new innovations. In North America, innovations have been lagging even further behind, with 29% of launches in the first five months being fresh ideas, below the global average.

Regarding what she hears from companies about innovation, Keren Novack, Curion’s President, said “Many companies claim they’re all-in to innovate, but in reality, progress is stalling. It’s being held back by price hikes, consumer backlash, and a reluctance to truly push boundaries.”

She goes on to say, “The market isn’t asking for more price hikes. Neither are consumers. They’re craving true innovation in fresh solutions and looking for meaningful shifts that break the mold.”

Consumers are looking for products that are smarter, more sustainable, and fit their needs better, so brands need to update their features and functions to match these preferences. At the same time, market trends and competitor movements show there’s a real need to innovate, whether that’s through new technology, responding to changing consumer values, or staying ahead of new brands shaking things up.

Food for thought:

What are the main factors holding companies in your category back from truly innovating, and do they risk falling behind by focusing only on renovation rather than genuine innovation to meet consumer demands?

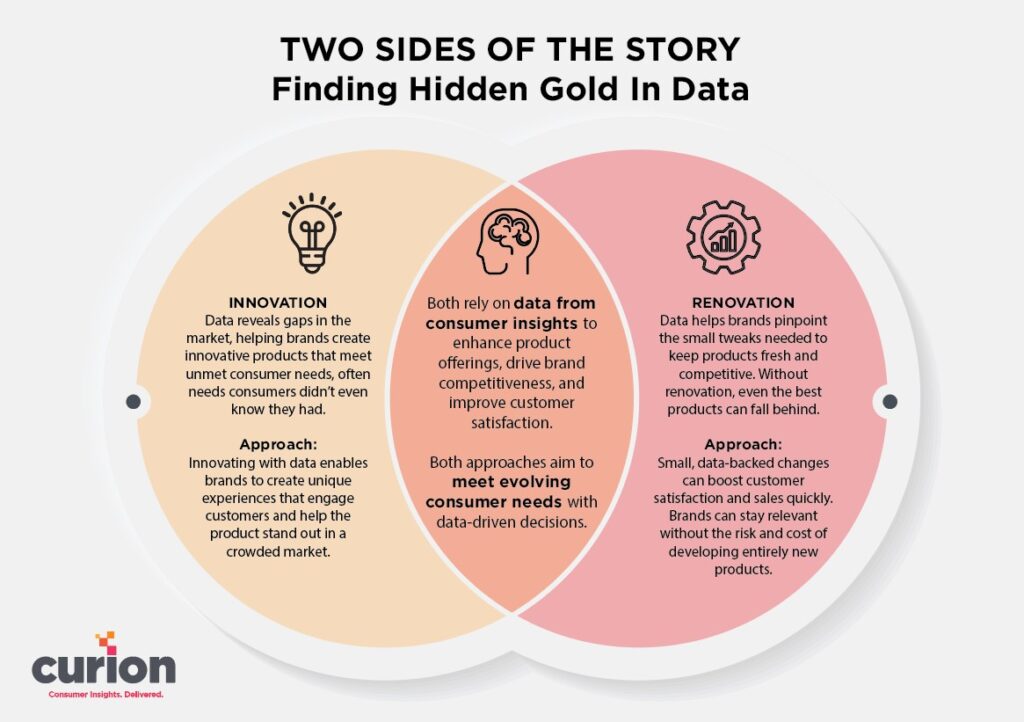

Hidden Gold in Data

Displace TV shook up its category with the world’s first truly wireless 55-inch 4K TV. No cables and no clutter, this product boasts of a hot-swappable battery and vacuum technology so people can mount it anywhere, giving total freedom to reimagine their home entertainment setups.

Consumers today can easily spot the difference between true innovation and product renovations, which is pushing brands to shift more toward new breakthroughs. Companies are turning to data-backed consumer insights for spotting their next big opportunity. Powerful – and actionable – insights are uncovered to help brands tap into real consumer needs.

Innovation thrives when brands truly understand consumer pain points—the unsolved problems that frustrate customers and leave room for smarter, more effective solutions. Take wireless earbuds, for example: consumers were fed up with tangled cords and poor sound quality, driving companies like Apple to innovate with AirPods that seamlessly connect and deliver high-quality audio. But the work doesn’t stop there. Market trend analysis helps brands anticipate what consumers will want next, like the shift toward noise-cancelling or fitness-focused features. Digging into consumer behavior data further reveals how products are used (or ignored), offering clues to refine features, fix flaws, or even create something entirely new that can capture attention in a crowded market.

As another example, a durable goods company worked with Curion and discovered how consumers, unaware of their own behavior, found a workaround for a common household product that was difficult to use as intended, revealing the need for a new, more innovative solution.

Food for thought:

What types of consumer data are most valuable for identifying innovation opportunities, and how can companies ensure they interpret this data effectively to drive meaningful innovation?

The Future of Innovation in a Changing World

In today’s market with consumer demands constantly shifting, product innovation for brands must keep up or risk becoming irrelevant. Shoppers now expect products that fit seamlessly into their lives, which means products must evolve and look beyond what consumers want today, into anticipating what they’ll need tomorrow.

The future of shopping for consumers is personal, connected, and social. Product ratings, recommendations, and social influence are at the heart of it. In 2023, social media sales made up 18.5% of all online purchases, and that number is growing with social commerce expected to exceed $8 billion by 2030. The bottom line is consumers trust and are influenced by other consumers and people they know. Around 88% rely on recommendations from friends or family, and 82% follow the advice of micro-influencers.

Consumers are using social platforms to communicate their preferences across every category. This influence is transforming innovation for brands by offering real-time insights, engaging consumers in the creative process, fast-tracking product development, and using influencers to spread new ideas, shaping a faster, more connected future for business.

Looking ahead, companies seeking to innovate will face both exciting opportunities and tough challenges, especially in areas like AI, green tech, and personalized experiences where pushing boundaries is a key element to make a real impact.

Change is constant and consumer behavior is unpredictable, so brands will eventually face the critical decision to innovate or renovate.

Consumer insights, product evolution, and market trends will continue to be necessary and shape the future of innovation. No matter which direction each brand chooses, powerful data drives both innovation and renovation. The future belongs to those who keep pushing forward, whether that means reinventing or reimagining what’s already in motion.

Curion specializes in delivering impactful insights to the world’s top CPG companies, helping them develop winning, repeatedly purchased products. Curion’s deep data-driven product insights, sensory expertise, and state-of-the-art consumer centers enable them to uncover responses to critical client objectives. With over five decades of experience in the product testing industry, Curion is dedicated to guiding clients with their proprietary XP Xperience Performance platform, connecting brands to consumers at every step.

An innovator in the industry, Curion recently developed a groundbreaking benchmarking product testing method, the Curion Score™, which has become a trusted and sought after tool within the industry. As one of the largest product and consumer insights companies in the U.S., Curion has built a reputation for excellence and trust among the world’s leading consumer brands. Curion’s commitment to innovation and expertise, coupled with a passion for delivering actionable insights, makes Curion a valuable partner for companies looking to develop and launch successful products.